Benefit from low taxes in Lucerne

Take advantage of the numerous cost benefits in the canton of Lucerne. The tax burden for companies is low and incomes are taxed moderately. The city of Lucerne offers lower location costs than the cities of Basel, Geneva and Zurich. Low corporate taxes are decisive for the choice of location.

Corporate taxes

Compared with other countries, Switzerland has always impressed with its low tax burden for companies. Some of the most tax-favorable Swiss locations are in the canton of Lucerne. The most important taxes for legal entities are the profit tax and the capital tax.

Profit tax

The effective tax burden for corporate profits varies in the canton of Lucerne depending on the municipality. Meggen is the most tax-efficient location.

Capital tax

From 2025 to 2027, the ordinary capital tax rate per tax unit will be 0.25 ‰ (per mille) of taxable equity. For the City of Lucerne (3.35 tax units), this currently corresponds to 0.8375 ‰ (per mille). The portion of equity attributable to qualifying participations, intellectual property rights, and intra-group receivables will be taxed at a reduced fixed capital tax rate of 0.01 ‰ (per mille).

Starting in 2028, all equity will be uniformly taxed at a fixed capital tax rate of 0.01 ‰ (per mille). This change will primarily benefit legal entities with high levels of equity.

Patent Box

The patent box allows legal entities, partnerships, and self-employed individuals to benefit from reduced taxation on profits derived from qualifying intellectual property rights. Upon request, profits from patents or comparable rights can be reduced by up to 90%. The extent of the reduction is based on the proportion of related research and development costs that were borne by the company itself.

Income taxes

Lucerne is a popular residential location for entrepreneurs. Income is taxed moderately. When choosing a place to live, the total cost of ownership plays an important role. It speaks in favor of Lucerne.

Withholding tax

Foreigners who work in Switzerland on a salaried basis and do not yet hold a C settlement permit are liable to withholding tax. The withholding tax is deducted directly by the employer.

Lump sum Taxation

Individuals who take up residence in Switzerland for tax purposes for the first time or after a ten-year absence from the country may pay tax at cost if they are not gainfully employed in Switzerland.

Other taxes

The canton of Lucerne does not have a gift tax or a property tax.

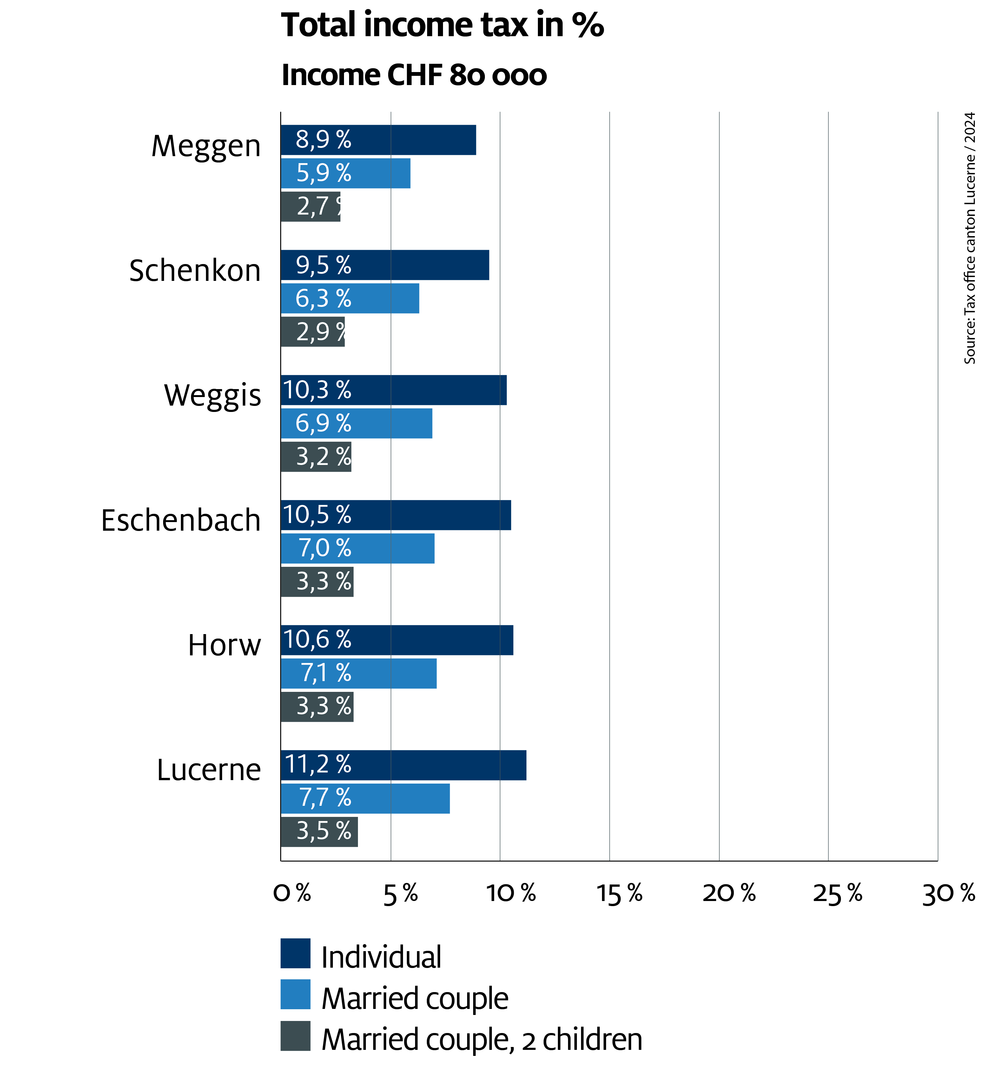

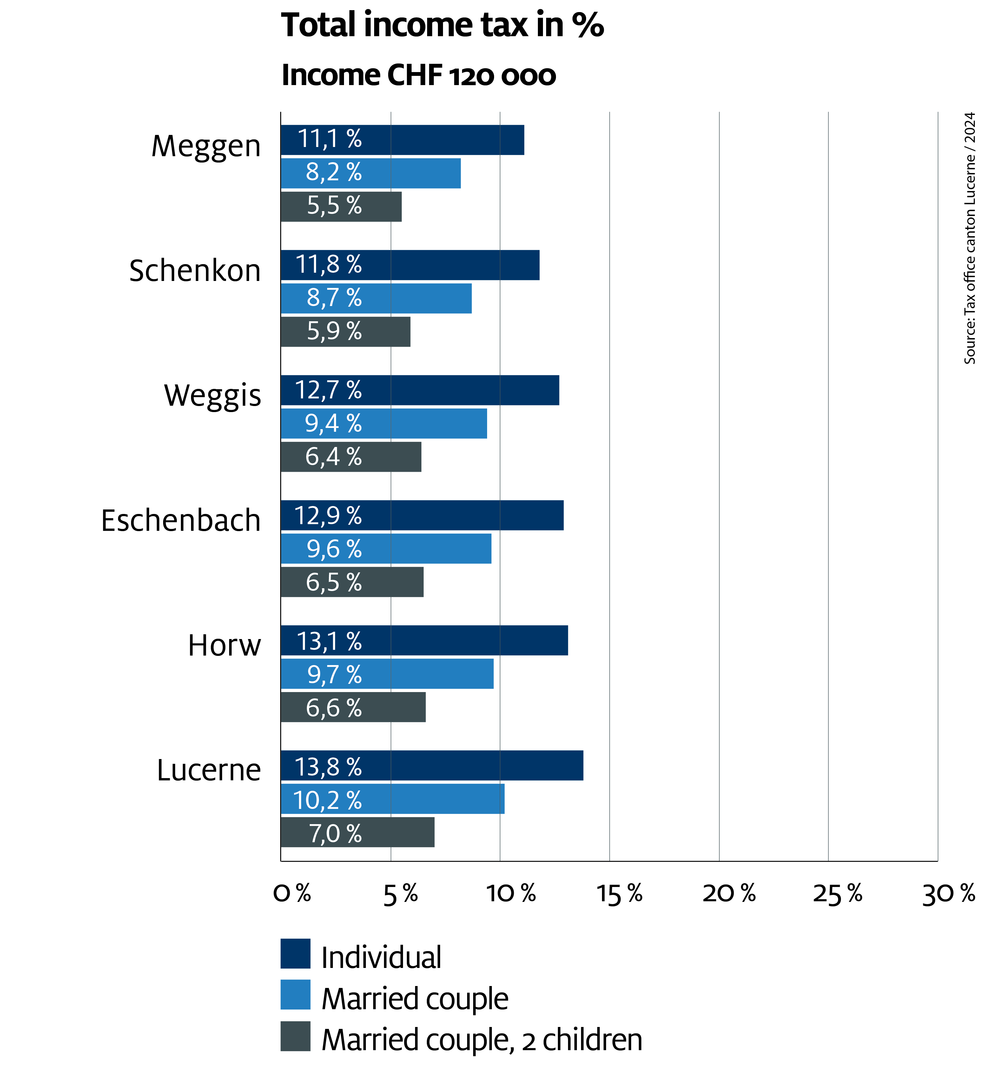

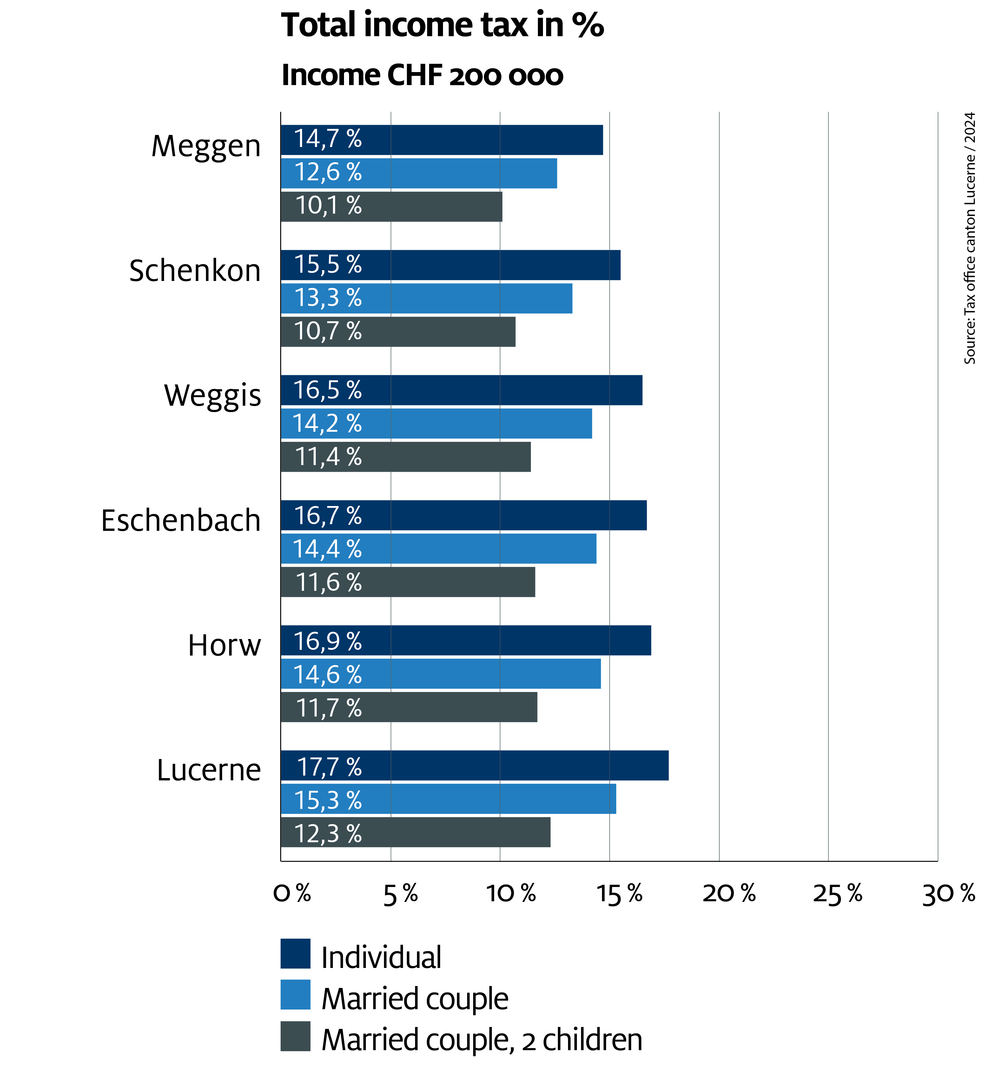

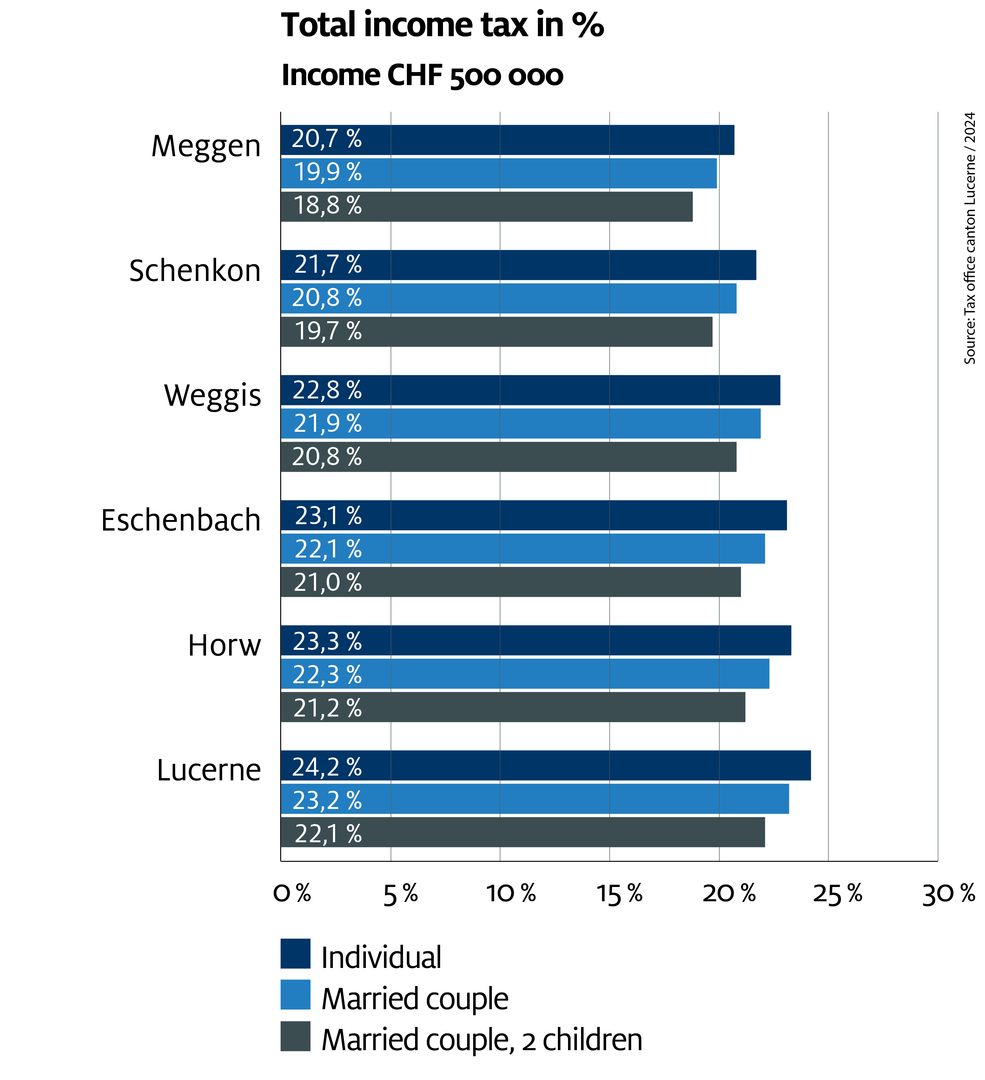

Income tax burden in %

How high are the taxes in the canton of Lucerne? Income taxes are primarily based on the amount of income. In addition, assets, marital status, number of children, religious denomination and place of residence also play an important role.

Comparisons by place of residence, income and marital status

(incl. federal tax, without church tax)

More information about the Swiss tax system:

I will assist you with questions about the tax system.

Mathias Lischer

Head of Promotion & FDI

Phone +41 41 367 44 03